MEDICARE SUPPLEMENT (Medigap) PLANS

A Medigap policy is health insurance sold by private insurance companies to fill the “gaps” in Original Medicare Plan coverage. Medigap policies help pay some of the health care costs that the Original Medicare Plan does not cover.

Generally, when you buy a Medigap policy you must have Medicare Part A and Part B. You will have to pay the monthly Medicare Part B premium. In addition, you will have to pay a premium to the Medigap insurance company.

Key Features:

-

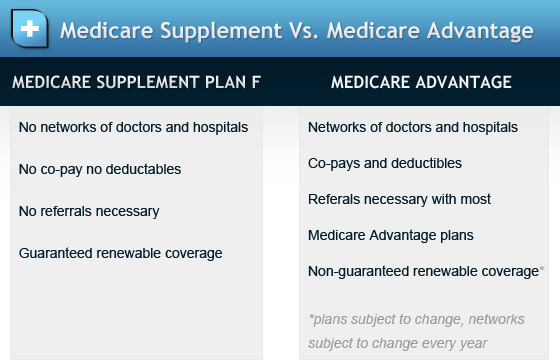

No networks, no referrals needed. Use with any provider that accepts Medicare.

-

Medigap Policies help pay reduce or eliminate deductibles, copays, coinsurance, Part B excess charges, and medical emergencies outside of the U.S.

-

Medigap policies do not include prescription coverage. Many choose to pick a stand alone Part D prescription in their area.

-

Benefits are standardized from company to company.

-

There is no medical underwriting, if you enroll in a Medigap plan when you first become eligible for Medicare. After this period, you are subject to medical underwriting and could be declined.

-

You and your spouse must each buy separate Medigap policies.